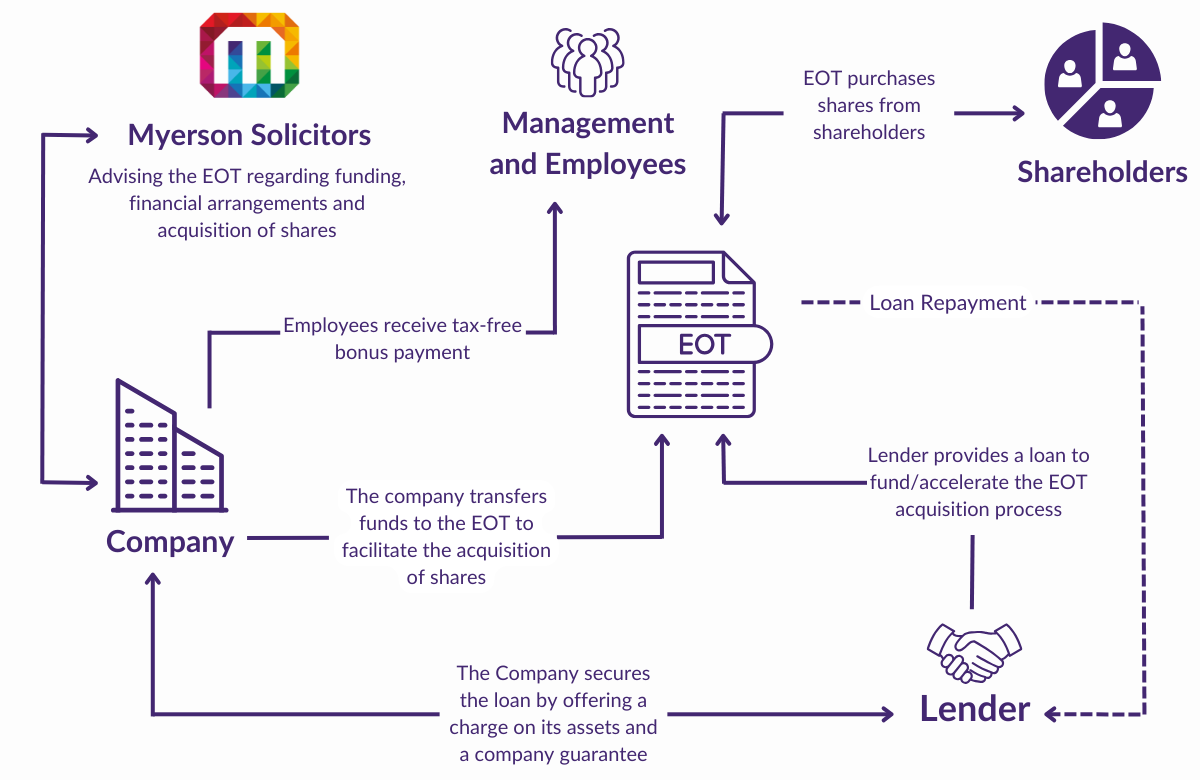

Employee Ownership Trusts (EOTs) are trusts established for the purpose of acquiring shares from the current owners of a company and holding them for the benefit of the employees of the company, thereby allowing the employees to have indirect ownership of the company.

EOTs have become an increasingly popular option for business owners looking to sell their company while offering a seamless transition of ownership, ensuring the company’s long-term success and preserving its culture.

There are numerous advantages to this for both the owners and employees, including significant tax advantages - 100% relief from capital gains tax for the owners and no income tax on employee bonuses up to £3,600 per annum.

Our Banking Lawyers explore the different EOT funding options, from equity to debt finance, and how they can help facilitate the acquisition of shares while ensuring a smooth transition for both business owners and employees.